인프런 커뮤니티 질문&답변

What reasons could delay my IRS 310 Treas tax refund?

작성

·

236

0

The IRS Treas 310 is an average ACH direct deposit refund or stimulus payment from a filed tax return, where there have been no offsets to the amount refund. If you got payment by direct deposit into your account but are not sure what it is for? No problem here's some information to help you figure that out. A refund from a filed tax refund, including an amended tax return or an IRS tax adjustment to your tax account, will show as being from the IRS.

And you are not alone. The IRS in the United States has begun to distribute additional refund checks to taxpayers who paid too much in employment compensation tax last year. However, many people did not know why irs treas 310 tax ref randomly deposited. So let's begin and understand it.

What are the IRS 310 Treas tax refund checks for?

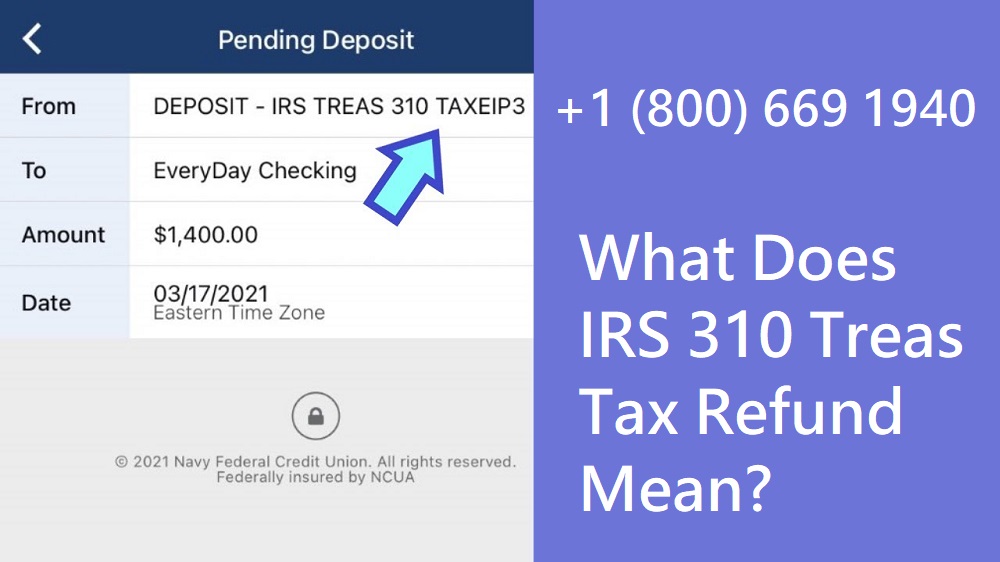

Due to coronavirus's economic impact, the IRS in the United States sent out COVID-19 relief checks to more than 25 million Americans in the fourth round of payments, which brought the total payments from the last stimulus package to more than 156 million payments, worth 372 billion dollars. And most social security payments were primarily distributed by direct deposit and paper checks. There is terms worth for those stimulus check payments landing in a bank account- irs Treas 310 tax refund.

So the 310 is a code that identifies transactions as a refund from a filed tax return in the form of direct deposit.

How do I get my IRS 310 Treas tax refund?

You may see this transaction on your bank statement due to filed tax return. Until the end of 2021, the IRS disbursed the scheduled and missed payments for stimulus checks and advance tax credits. The America Rescue Plan provided economic impact payment of up to $1400 for eligible individuals or $28,00 for married couples filing jointly, plus $14,00 for each qualifying dependent, including adult dependents. However, if you did not get it, the irs 310 tax refund is pending. There could be reasons behind it; I will explain them later in this blog.

To get the irs treasury 310 tax refund you can get it through direct deposit if you have your banking info; otherwise, the refund will be mailed as a paper check to the address on record. You can also use online services like Cash App to get your tax refund a few days sooner. If you are eligible to receive the stimulus payment or child tax credit via direct deposit, it will automatically be deposited into the same account used last year.

What reasons could delay my IRS 310 Treas tax refund?

If you overpaid your taxes in 2021, you would receive that money back. However, if the irs 310 Tax refund pending- here are some of the reasons behind it-

- There are some errors in your tax return

- You have not properly filed the Cash App taxes- it's incomplete

- The refund is suspect of identity theft or fraud

- May your IRS treas 310 tax refund is already deposited

- Your direct deposit is not working- review the details or get the tax refund via other methods such as paper checks.

답변